In today’s interconnected agricultural and industrial economy, few commodities influence global food security and industrial production as directly as urea. With a nitrogen content of ≥46%, urea (CO(NH₂)₂) is the backbone of nitrogen fertilizers worldwide and a key raw material for resins, pharmaceuticals, explosives, dyes, and specialty chemicals.

Over the past five years, the international price of urea has moved from relative stability to historic highs and then into a new phase of recalibration. For fertilizer importers, agricultural distributors, mining companies, and government procurement agencies, understanding these fluctuations is not optional — it is a strategic necessity.

This article explores:

The historical evolution of the international price of urea

The real economic forces driving volatility

Regional price comparisons and forecasts

Actionable procurement strategies

A recommended large-scale supplier with proven international capability

Let’s examine why the international price of urea has become one of the most closely watched indicators in the global fertilizer market.

A Market That Moves with Energy: The Real Driver Behind Urea Prices

Urea is produced from ammonia, which is synthesized primarily using natural gas. This means the international price of urea is fundamentally tied to global energy markets.

When gas prices rise, fertilizer costs rise. When gas supplies are disrupted, fertilizer plants shut down. And when supply shrinks, prices surge.

The Energy Shock That Changed Everything

Between 2021 and 2022, natural gas prices in Europe more than doubled. Fertilizer production costs soared, forcing many European plants to suspend operations. The result? A dramatic spike in the international price of urea.

Natural Gas vs. International Price of Urea

| Year | Avg. Natural Gas Price (USD/MMBtu) | Avg. Urea Price (USD/MT) |

|---|---|---|

| 2021 | 6.5 | 480 |

| 2022 | 12.0 | 820 |

| 2023 | 5.8 | 420 |

The data clearly demonstrates a strong positive correlation between energy costs and the international price of urea.

A Look Back: How the International Price of Urea Evolved

Understanding historical pricing patterns provides valuable insight into future trends.

Average International Price of Urea

| Year | Avg. Price (USD/MT) | Market Condition |

|---|---|---|

| 2018 | 260 | Stable demand |

| 2019 | 245 | Slight oversupply |

| 2020 | 270 | Pandemic disruption |

| 2021 | 480 | Energy inflation |

| 2022 | 820 | Supply crisis |

| 2023 | 420 | Correction phase |

| 2024 | 360–420 | Stabilizing |

The international price of urea reached record highs in 2022, nearly tripling compared to pre-pandemic levels. Since then, improved logistics and stabilized gas prices have brought the market into a more balanced state.

However, volatility remains an inherent characteristic of this sector.

For more information on urea pricing, please see this article: Price of Urea Per Ton

Global Production: Who Controls Supply?

Global urea production exceeds 200 million metric tons annually, but production capacity is not evenly distributed.

Global Urea Production by Region

| Region | Production (Million Tons) | Share (%) |

|---|---|---|

| China | 55 | 27% |

| South Asia | 35 | 17% |

| Middle East | 30 | 15% |

| Europe | 25 | 12% |

| North America | 20 | 10% |

| Others | 40 | 19% |

| Total | 205 | 100% |

China remains the world’s largest producer, giving Asian exporters strong influence over the international price of urea.

Export restrictions in major producing countries can quickly tighten supply and push prices upward.

Regional Price Comparison: Where Is Urea Most Competitive?

Even when global prices move together, regional differences remain.

International Urea Price by Export Hub

| Export Hub | FOB Price (USD/MT) | Competitive Advantage |

|---|---|---|

| China | 350–380 | Scale, cost efficiency |

| Middle East | 370–400 | Low gas cost |

| Russia | 360–390 | Large reserves |

| US Gulf | 400–430 | Domestic demand strength |

China’s cost advantage often positions it as one of the most competitive sources in the global market.

Demand Pressure: Feeding a Growing World

The international price of urea is not only about energy — it is also about food.

Global population growth and increasing grain demand continue to support nitrogen fertilizer consumption. Urea accounts for over half of total nitrogen fertilizer use worldwide.

Annual demand growth is estimated at 1.5–2%, driven by:

Expanding agricultural acreage

Crop yield optimization

Government fertilizer subsidies

Food security policies

Seasonal planting cycles also create short-term demand spikes that influence the international price of urea.

For more information on the applications of urea in agriculture, please refer to this article: The Application of Urea Fertilizer for Apple Trees

Forecast: Where Is the International Price of Urea Headed?

Looking ahead to 2025–2027, most analysts expect moderate stabilization, though fluctuations will remain linked to energy markets and geopolitics.

Forecast of International Urea Prices

| Year | Expected Range (USD/MT) | Market Outlook |

|---|---|---|

| 2026 | 370–480 | Demand-driven growth |

| 2027 | 380–500 | Gradual upward trend |

While extreme spikes like 2022 may be less likely, the international price of urea will continue responding to global economic shifts.

Strategic sourcing is therefore essential.

Choosing the Right Supplier in a Volatile Market

In a market defined by volatility, stability becomes the ultimate competitive advantage.

Buyers should prioritize suppliers with:

Large-scale production capacity

Advanced international technology

Export compliance credentials

Diversified product portfolio

Proven global trade experience

One company that meets these criteria is San Corporation.

San Corporation: A Reliable Partner in the Global Fertilizer Market

Founded in 2002, San Corporation has established itself as:

The largest ammonium nitrate exporting enterprise in China

One of the few enterprises approved by the National Defense Department for exporting dangerous goods

Home to China’s largest ammonium nitrate production base

Strong Production Capacity

Annual ammonium nitrate production: 1.2 million tons

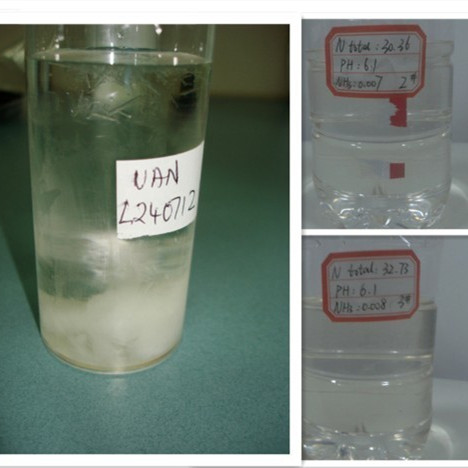

Urea Ammonium Nitrate (UAN) capacity: 300,000–400,000 tons annually

Export volume (as of 2012): 80,000 tons

The company operates a large-scale manufacturing complex with:

Advanced production lines

Dedicated research center

Patented technologies from Germany, Japan, France, Norway, and other countries

Its strategic philosophy — “Technology builds enterprises, steady operation prospers them” — ensures sustainable development and consistent product quality.

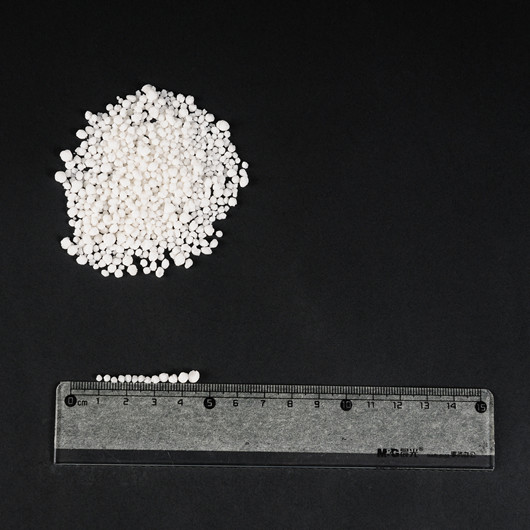

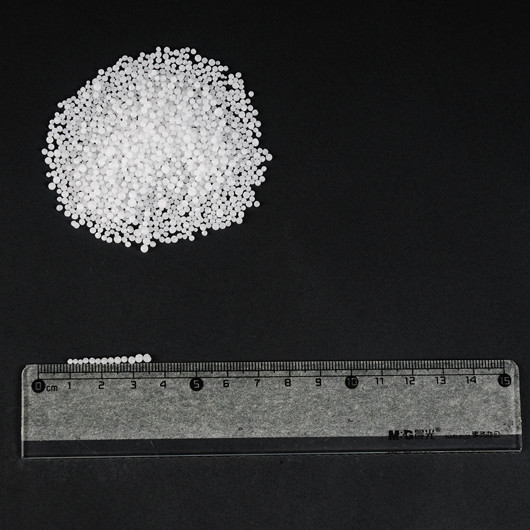

Urea Product Specifications

Nitrogen Content: ≥46%

Free Water: ≤0.5%

Biuret: ≤1.0%

Particle Size (2.0–4.75mm): ≥90%

Appearance: White or slightly reddish solid granules

Packaging: 50kg PP/PE bags or customized

High-quality urea ensures:

Efficient nitrogen release

Reduced caking during storage

Stable industrial processing

Safe transportation

Price alone does not determine purchasing decisions. Quality consistency directly impacts agricultural productivity and industrial safety. For bulk buyers, reliable quality can significantly reduce downstream operational risks.

View their products: Urea

Competitive Product Advantages

San Corporation supplies:

Urea

Porous Prilled Ammonium Nitrate (PPAN)

Calcium Ammonium Nitrate

Calcium Nitrate

Urea Ammonium Nitrate Solution

Urea Advantages

Nitrogen ≥46%

Strict moisture control

Stable granulation

Competitive export pricing

Bulk supply capability

The company focuses on large-scale buyers, including:

Global distributors

Government procurement agencies

Military buyers

Large mining enterprises

Due to large production capacity and complex logistics, small-volume orders are not accepted — ensuring efficiency and stability in bulk shipments.

Conclusion: Turning Market Volatility into Opportunity

The international price of urea has evolved from a stable agricultural indicator into a strategic global commodity benchmark influenced by energy markets, geopolitics, and food security.

For buyers navigating this complex environment, the key is not merely tracking prices — but partnering with reliable, technologically advanced, and large-scale suppliers capable of delivering consistent quality at competitive cost.

San Corporation, with its strong manufacturing base, advanced technology integration, and extensive export experience, represents a strategic choice for international buyers seeking stability in an inherently volatile market.

In a world where fertilizer prices can shift rapidly, choosing the right supplier may be the most important investment decision you make. Contact San Corporation to order urea.