Introduction: Why Urea Price Matters

When we talk about the urea price per ton, we're really talking about a barometer of global fertilizer economics. Urea (CO(NH₂)₂), with ≥ 46% nitrogen content and low impurities, is used widely in agriculture, resin, pharmaceutical and even explosive industries. So the ton‑price of urea echoes through farms, factories and global food chains.

I want you to feel this – that when the urea price per ton jumps, it ripples through planting seasons, trade policy, and ultimately, global food security.

Find out the price of urea per ton.

Global Pricing Snapshot Mid‑2025

Table 1. Global Urea Price per Ton, mid‑2025

| Region / Source | Price (USD/ton) | Notes (June–July 2025) |

|---|---|---|

| Retail U.S. (DTN) | $656–662 | DTN per‑ton retail average in early June |

| World Bank global price | $420.5 | World average in June 2025 |

| China export FOB (granular) | ~$370 | Offered at major Chinese ports |

| Middle East FOB | $365–380 | Stable June pricing |

| Southeast Asia CFR | $410–430 | Slight downward influence post‑exports |

In the U.S., the average retail price reached about $656 per ton in mid‑June, rising to $662 by early June, up 11–13 % m/m. Globally, World Bank data puts the June 2025 average at $420.5/ton. Meanwhile, China granular urea is being quoted around $370/ton FOB, undercutting prices in Southeast Asia and Brazil.

Regional Trends & Causes

Let’s zig‑zag through regions and note why prices diverge:

North America / U.S.: Retail urea at $656–662/ton, up sharply from ~$555 in May 2024 – a ~20–25 % increase year‑on‑year.

Asia‑Pacific (China): Domestic price roughly $350/ton, maintaining competitive edge thanks to sheer volume of supply.

India: Slightly higher—about $360/ton, despite growing domestic output—demand remains robust.

Middle East: FOB quoted at $365–380, shaped by export policy shifts and energy costs.

Southeast Asia & Brazil: CFR prices in the $410–430 range, softening a bit as China resumes quota‑based exports.

Month‑by‑Month Momentum

Table 2. U.S. Retail Urea Price Trends, Spring–Summer 2025

| Period | Price (USD/ton) | % change from prior month |

|---|---|---|

| May 2025 | $652 | +13 % from April ~$579 |

| Early June 2025 | $656 | slight increase |

| June last week | $662 | +11 % vs May |

The U.S. retail numbers show a sharp climb in late spring. DTN’s classification defines a “significant move” as > 5 %, and sure enough, urea rose 13 % in May and another 11 % early June.

Drivers Behind Price Fluctuations

Chinese export policy uncertainty: Quota limits and export periods (May–Sep) introduced downward pressure on FOB prices.

Global demand spikes: Peak planting in Brazil, India, West Africa created tight seasonal demand.

Energy and logistic costs: Rising ammonia input prices, port congestion, higher shipping insurance.

Geopolitical tensions: Middle East unrest, threats to Iranian supply, Red Sea rerouting—all ripple into price premium.

Historical Context: How High is High?

World Bank data shows that the long‑term average urea price since 1960 is $171.5/ton, with record highs hitting $925/ton in April 2022. Compared with the current ~$420.5/ton average, we’re above the historical mean—but still well below peak levels. Still, regional retail in the U.S. at ~$660/ton pushes the global average well upward.

San Corporation and Urea Market Positioning

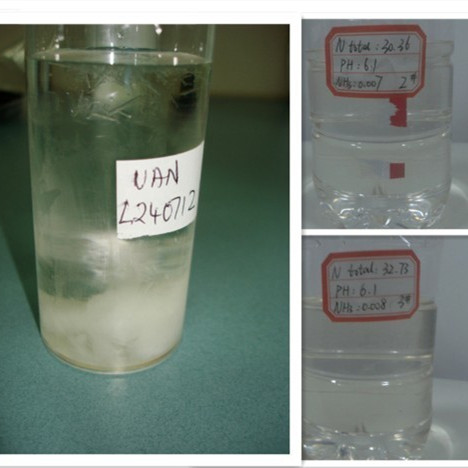

San Corporation—founded in 2002—is the largest ammonium nitrate exporting enterprise in China, and one of the few approved to export dangerous goods by the National Defense Department. Home to China’s largest ammonium nitrate production base, the company blends robust technological and capital strengths, aligning with its strategic motto: “Technology builds enterprises, steady operation prospers them.”

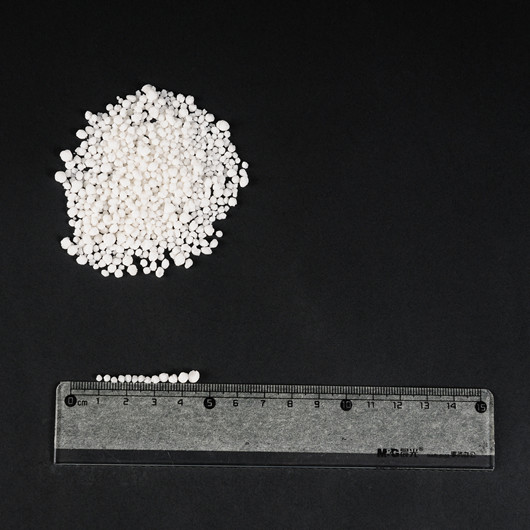

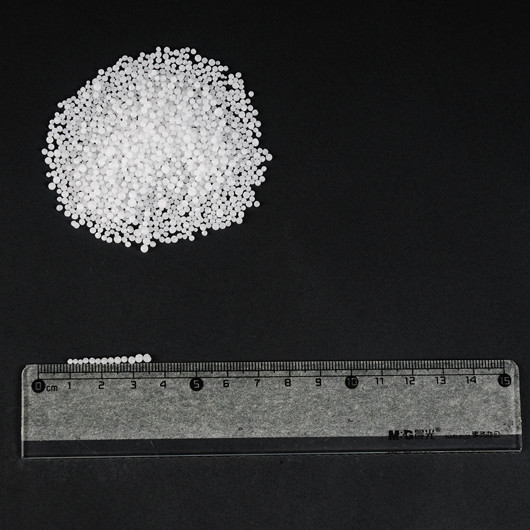

Within its fertilizer portfolio, San Corporation produces high‑quality urea (≥ 46% N, ≤ 0.5% free water, ≤ 1% biuret, ≥90% in 2.0‑4.75 mm size), packed in 50 kg PP/PE bags or as per customer specs—a product engineered for low cost, wide variety, and top quality.

Given their R&D center, international patented tech (Germany, Japan, France, Norway), and scale—San Corporation’s urea and urea‑ammonium nitrate solutions (planned full production in H1 2013, 300,000‑400,000 t/yr) offer competitive supply to global markets. If China's granular urea is trading FOB at $370/ton, San’s efficient product qualifies them to compete effectively at or below that range while offering superior consistency and technical support.

Pricing Strategy and Buyer Tips

If you're a buyer (distributor, miner, government procurement, or military buyer), here’s how to think:

Monitor China export quotas: If allowed volume increases later in 2025, FOB prices may soften further.

Lock in contracts early: At seasonal peaks (June–August), prices jump; forward-booking helps hedge risk.

Consider inland retail premiums: U.S. retail ~$660/ton versus global FOB ~$370–420/ton—transport, duties, markup matter.

Evaluate quality & service: San Corporation emphasizes quality, low‑cost, secure service—especially for large‑volume users.

Longer‑Term Outlook & Forecast (Q3–Q4 2025)

Based on current indicators:

China is expected to resume exports under quotas through October, which may suppress FOB prices to $360–380/ton.

Indian tender cycles likely to support CIF levels of $420–450/ton.

DTN, Profercy and other market watchers anticipate sustained pressure on retail in North America and Latin America through mid‑2025 planting season.

If geopolitical or energy disruptions escalate, markets could spike again toward $500/ton+, especially in the spot segments.

Reflections & Final Thoughts

There’s something almost poetic in how the urea price per ton dances with macro‑economic events, trade rules, crop cycles—and yet remains grounded in pure chemistry and factory throughput. The gulf between $370/ton FOB and $660/ton retail isn’t accidental; it’s the narrative of continuum logistics, distribution, risk, policy, and regional margins.

San Corporation’s approach—to combine patented multi‑country technology, large‑scale factory lines, and strategic philosophy—positions it well in this shifting landscape. Their products meet the technical spec, are competitively priced, and offer scalable supply for global buyers.

Table 3. Comparative Urea Price Summary, mid‑2025

| Segment | Estimated Price (USD/ton) |

|---|---|

| China granular FOB | ~$370 |

| Middle East FOB | $365–380 |

| Southeast Asia CFR | $410–430 |

| Brazil CFR import | ~$420–435 |

| Global World Bank average | $420.5 |

| U.S. retail average | $656–662 |